Understanding the Benefits and Risks of Interest Only Mortgage Loan Rates

#### Interest Only Mortgage Loan RatesInterest only mortgage loan rates refer to a type of mortgage where the borrower pays only the interest for a specifie……

#### Interest Only Mortgage Loan Rates

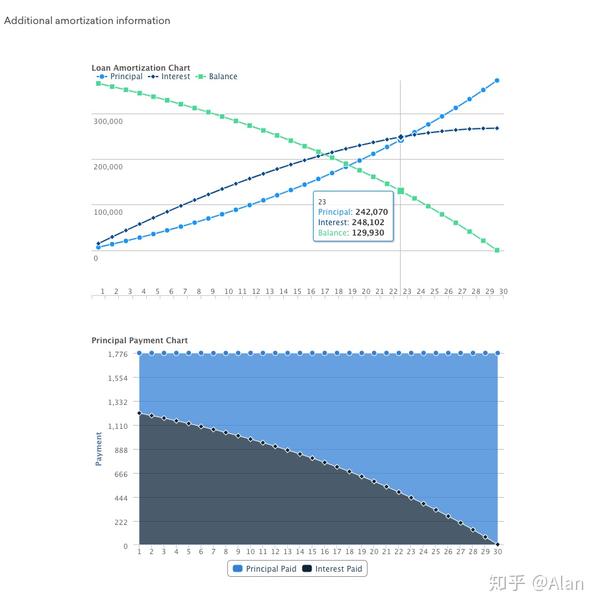

Interest only mortgage loan rates refer to a type of mortgage where the borrower pays only the interest for a specified period, typically 5 to 10 years, after which they begin to pay both principal and interest. This can lead to lower initial monthly payments, making it an attractive option for some borrowers. However, it also comes with its own set of risks and considerations that potential homeowners should be aware of.

#### Advantages of Interest Only Mortgage Loan Rates

One of the primary benefits of interest only mortgage loan rates is the lower initial payment. This can provide significant cash flow advantages, allowing borrowers to allocate their funds elsewhere, such as investing in stocks or saving for future expenses. For those who expect their income to increase over time, this can be a strategic choice.

Additionally, interest only loans can be beneficial for individuals who may have irregular income, such as freelancers or commission-based workers. The lower initial payments can help them manage their finances more effectively during lean months, providing a buffer that can help avoid financial strain.

#### Disadvantages of Interest Only Mortgage Loan Rates

However, there are notable risks associated with interest only mortgage loan rates. The most significant concern is that borrowers are not building equity in their homes during the interest-only period. This can lead to a situation where the homeowner owes more than the home is worth if property values decline.

Furthermore, once the interest-only period ends, the borrower will face a sudden increase in monthly payments as they begin to pay off the principal. This can create financial stress and may lead to difficulties in budgeting if the borrower has not adequately prepared for this transition.

#### Who Should Consider Interest Only Mortgage Loan Rates?

Interest only mortgage loan rates may be suitable for specific types of borrowers. For instance, those who are confident in their ability to invest the difference in payments wisely or who anticipate a significant increase in their income might find this type of mortgage appealing. Additionally, real estate investors who plan to sell the property before the interest-only period ends may also benefit from this structure.

However, it is crucial for potential borrowers to conduct thorough research and consider their financial situation carefully before opting for an interest only mortgage. Consulting with a financial advisor or mortgage professional can provide valuable insights and help borrowers make informed decisions.

#### Conclusion

In summary, interest only mortgage loan rates can offer flexibility and lower initial payments, making them attractive to certain borrowers. However, they also carry risks that must be carefully weighed. Understanding both the advantages and disadvantages is essential for anyone considering this type of mortgage. By doing so, borrowers can make more informed choices that align with their long-term financial goals.