Unlocking Savings: Understanding Home Loan Rates for Refinance in 2023

#### Home Loan Rates for RefinanceRefinancing your home loan can be a strategic financial move, especially in a fluctuating interest rate environment. Under……

#### Home Loan Rates for Refinance

Refinancing your home loan can be a strategic financial move, especially in a fluctuating interest rate environment. Understanding home loan rates for refinance is crucial for homeowners looking to reduce their monthly payments, access equity, or switch to a more favorable loan term. In 2023, many homeowners are considering refinancing as a way to capitalize on lower interest rates and improve their financial situation.

#### Why Refinance?

Homeowners might choose to refinance for several reasons. One of the primary motivations is to lower their interest rate. If market rates have dropped since you first secured your mortgage, refinancing could significantly reduce your monthly payments. Additionally, refinancing can allow homeowners to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing more stability in monthly payments.

Equity is another compelling reason to refinance. If your home has appreciated in value, refinancing can enable you to tap into that equity for home improvements, debt consolidation, or other financial needs. By understanding home loan rates for refinance, you can make informed decisions about the timing and type of refinance that best suits your financial goals.

#### Current Trends in Home Loan Rates

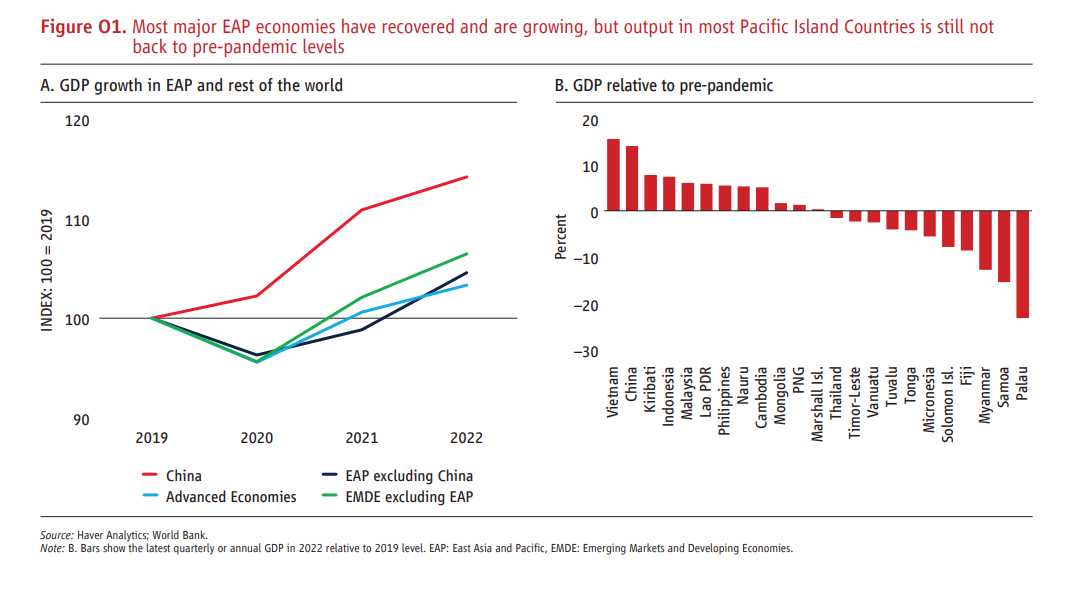

As of 2023, the landscape of home loan rates for refinance has been influenced by various economic factors, including inflation, Federal Reserve policies, and overall market conditions. Home loan rates have seen fluctuations, and it is essential for homeowners to stay updated on current trends to make the most advantageous refinancing decisions.

Potential borrowers should monitor the average rates offered by lenders and consider how these rates compare to their existing mortgage rates. Tools like mortgage calculators can help estimate potential savings and provide a clearer picture of what refinancing might entail.

#### How to Choose the Right Lender

Finding the right lender is crucial when considering home loan rates for refinance. Different lenders may offer varying rates and terms, so it’s wise to shop around. Start by gathering quotes from multiple lenders, including banks, credit unions, and online mortgage providers. Pay attention not only to the interest rates but also to the fees associated with refinancing, such as closing costs and origination fees.

Additionally, consider the lender’s reputation and customer service. Reading reviews and seeking recommendations can help you find a lender that aligns with your needs and provides a smooth refinancing experience.

#### Timing Your Refinance

Timing is another critical aspect of refinancing. Homeowners should consider market conditions and their personal financial situation when deciding to refinance. If interest rates are projected to rise, it may be advantageous to act quickly. Conversely, if rates are high, waiting for a potential decrease could be a wiser choice.

It’s also important to evaluate your long-term plans. If you plan to stay in your home for an extended period, refinancing to a lower rate could yield significant savings. However, if you anticipate moving soon, the costs associated with refinancing may outweigh the benefits.

#### Conclusion

In summary, understanding home loan rates for refinance is essential for homeowners looking to optimize their financial situation. By evaluating the reasons for refinancing, current market trends, and the right lender, you can make informed decisions that align with your financial goals. With the right approach, refinancing can lead to substantial savings and improved financial stability in 2023 and beyond.