A Comprehensive Guide on How to Apply for an Unsubsidized Loan: Step-by-Step Instructions and Tips

Guide or Summary:Understanding Unsubsidized LoansEligibility RequirementsStep-by-Step Process to ApplyManaging Your Unsubsidized Loan**Translation of "how t……

Guide or Summary:

- Understanding Unsubsidized Loans

- Eligibility Requirements

- Step-by-Step Process to Apply

- Managing Your Unsubsidized Loan

**Translation of "how to apply for an unsubsidized loan":** 如何申请无补贴贷款

---

Understanding Unsubsidized Loans

Unsubsidized loans are a type of federal student loan that are not based on financial need. Unlike subsidized loans, the government does not pay the interest on unsubsidized loans while you are in school, during the grace period, or during deferment periods. This means that interest begins to accrue as soon as the loan is disbursed. Understanding the implications of taking out an unsubsidized loan is crucial for managing your education financing effectively.

Eligibility Requirements

Before diving into how to apply for an unsubsidized loan, it’s important to know the eligibility criteria. Generally, you must be enrolled at least half-time in an eligible degree or certificate program at a college or university. Additionally, you need to complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal student aid.

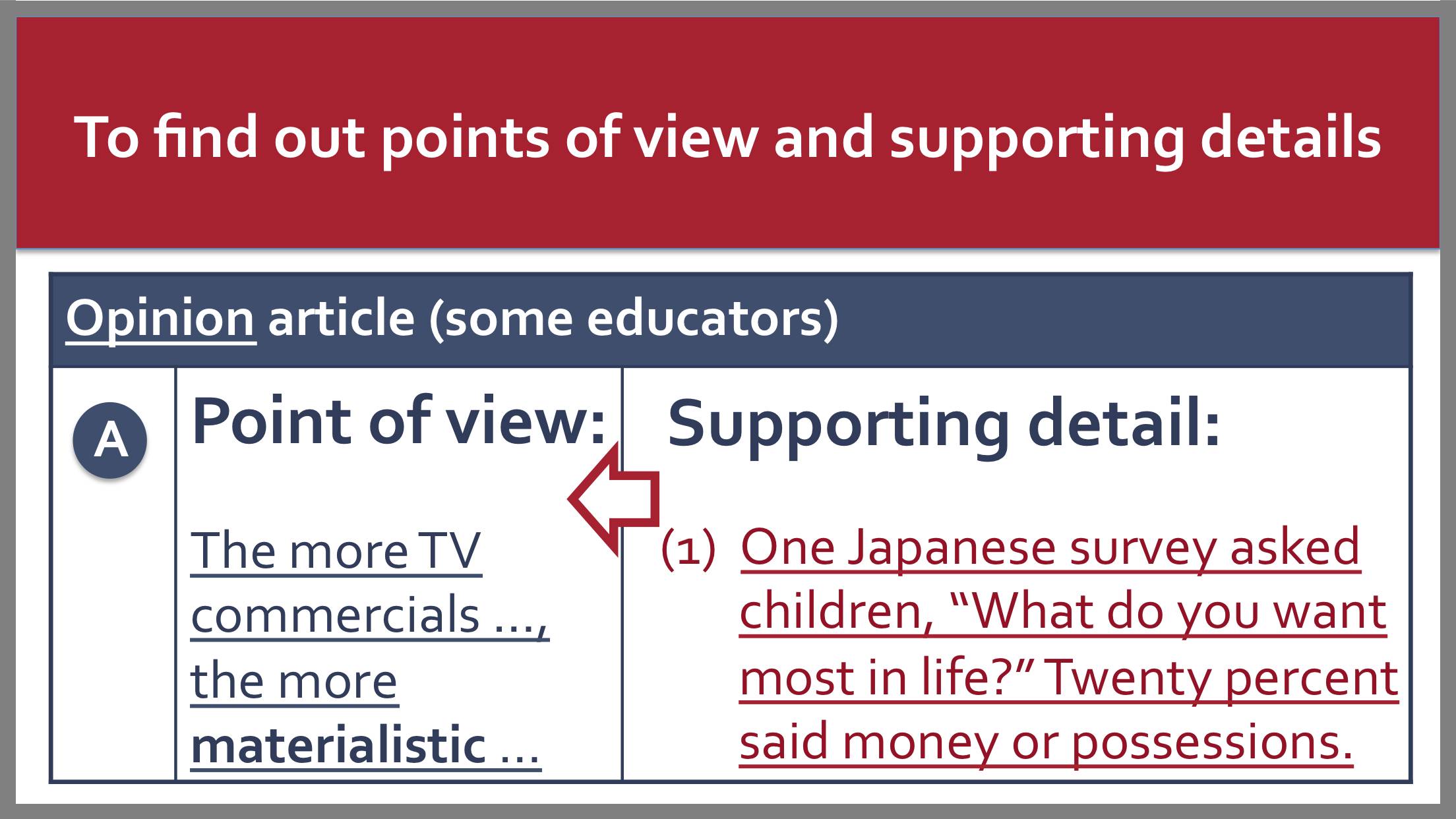

Step-by-Step Process to Apply

1. **Complete the FAFSA**: The first step in how to apply for an unsubsidized loan is to fill out the FAFSA. This form collects your financial information and helps determine your eligibility for federal student loans, including unsubsidized loans. Make sure to gather necessary documents such as your Social Security number, tax returns, and bank statements.

2. **Review Your Student Aid Report (SAR)**: After submitting your FAFSA, you will receive a Student Aid Report summarizing your financial information. Review this report carefully for any errors or discrepancies that may affect your loan eligibility.

3. **Receive Your Financial Aid Award Letter**: Once your FAFSA is processed, your school will send you a financial aid award letter detailing the types and amounts of aid you are eligible for, including unsubsidized loans. This letter will also outline the terms and conditions of the loans.

4. **Accept Your Loan**: If you decide to accept the unsubsidized loan, follow your school’s instructions to formally accept the loan amount. This may involve logging into your student portal and confirming your acceptance.

5. **Complete Entrance Counseling**: Before you can receive your loan funds, you must complete entrance counseling. This is an online tutorial that explains your rights and responsibilities as a borrower. It ensures you understand the loan terms, interest rates, and repayment options.

6. **Sign the Master Promissory Note (MPN)**: After completing entrance counseling, you will need to sign an MPN. This legal document outlines the terms of your loan agreement and states that you agree to repay the loan according to those terms.

7. **Loan Disbursement**: Once you complete all the necessary steps, your loan funds will be disbursed to your school. Typically, the funds are applied to your tuition and fees first, and any remaining balance may be given to you for other education-related expenses.

Managing Your Unsubsidized Loan

After understanding how to apply for an unsubsidized loan and receiving your funds, it’s essential to manage your loan wisely. Keep track of your loan balance and interest accrual, and consider making interest payments while you’re in school to reduce the total amount you owe after graduation. Familiarize yourself with repayment options available after you graduate, including income-driven repayment plans, which can make managing your debt more manageable.

Applying for an unsubsidized loan can be an effective way to finance your education, but it’s important to understand the responsibilities that come with it. By following the steps outlined above, you can navigate the application process with confidence. Remember to stay informed about your loan terms, and don’t hesitate to seek financial counseling if you have questions about managing your student loans.