How to Use Loans for Businesses to Boost Growth and Innovation

Guide or Summary:Understanding the Role of Loans in Business GrowthExpanding Operations with Loans for BusinessesInvesting in Innovation with Loans for Busi……

Guide or Summary:

- Understanding the Role of Loans in Business Growth

- Expanding Operations with Loans for Businesses

- Investing in Innovation with Loans for Businesses

- Improving Cash Flow with Loans for Businesses

- Enhancing Competitive Advantage with Loans for Businesses

In today's fast-paced business environment, growth and innovation are critical for staying competitive and achieving long-term success. However, the financial hurdles that come with expansion and innovation can be daunting. This is where loans for businesses come into play. By strategically using loans, businesses can unlock the potential for growth and foster a culture of innovation.

Understanding the Role of Loans in Business Growth

Loans for businesses are a crucial financial tool that can provide the necessary capital to fuel growth. These loans can be obtained from various sources, including traditional banks, online lenders, and government programs. They typically come with favorable terms, such as low interest rates and flexible repayment schedules, making them an attractive option for businesses looking to expand or invest in new projects.

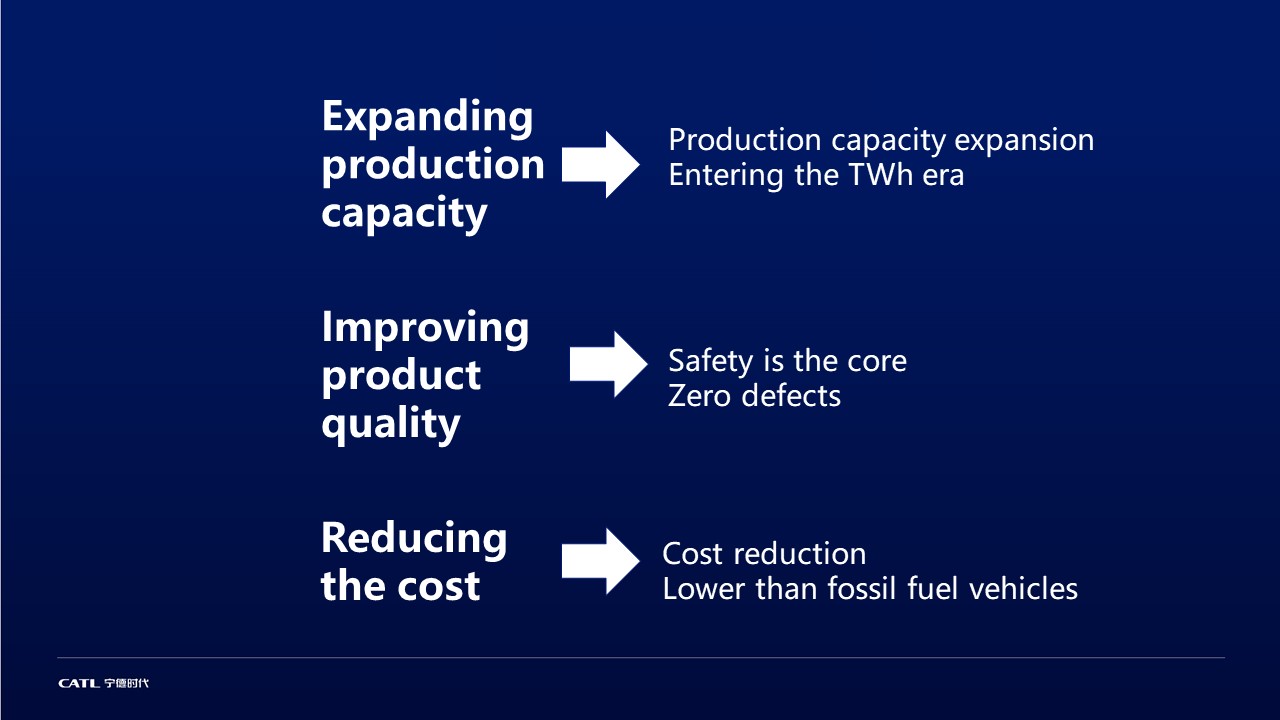

Expanding Operations with Loans for Businesses

One of the primary benefits of using loans for businesses is the ability to expand operations. Whether it's opening new locations, increasing production capacity, or investing in advanced technology, loans can provide the capital needed to achieve these goals. By expanding operations, businesses can increase their market share, improve efficiency, and ultimately, enhance profitability.

Investing in Innovation with Loans for Businesses

Innovation is a key driver of growth and competitive advantage. However, it often requires significant upfront investment in research and development, new technologies, or other innovative initiatives. Loans for businesses can provide the necessary funding to invest in innovation, allowing companies to stay ahead of the competition and differentiate themselves in the marketplace.

Improving Cash Flow with Loans for Businesses

Cash flow is a critical component of business success. However, cash shortages can be a significant challenge for growing businesses. Loans for businesses can provide the additional cash flow needed to cover expenses, pay suppliers, and invest in growth opportunities. By improving cash flow, businesses can maintain operational stability, reduce financial stress, and focus on long-term growth.

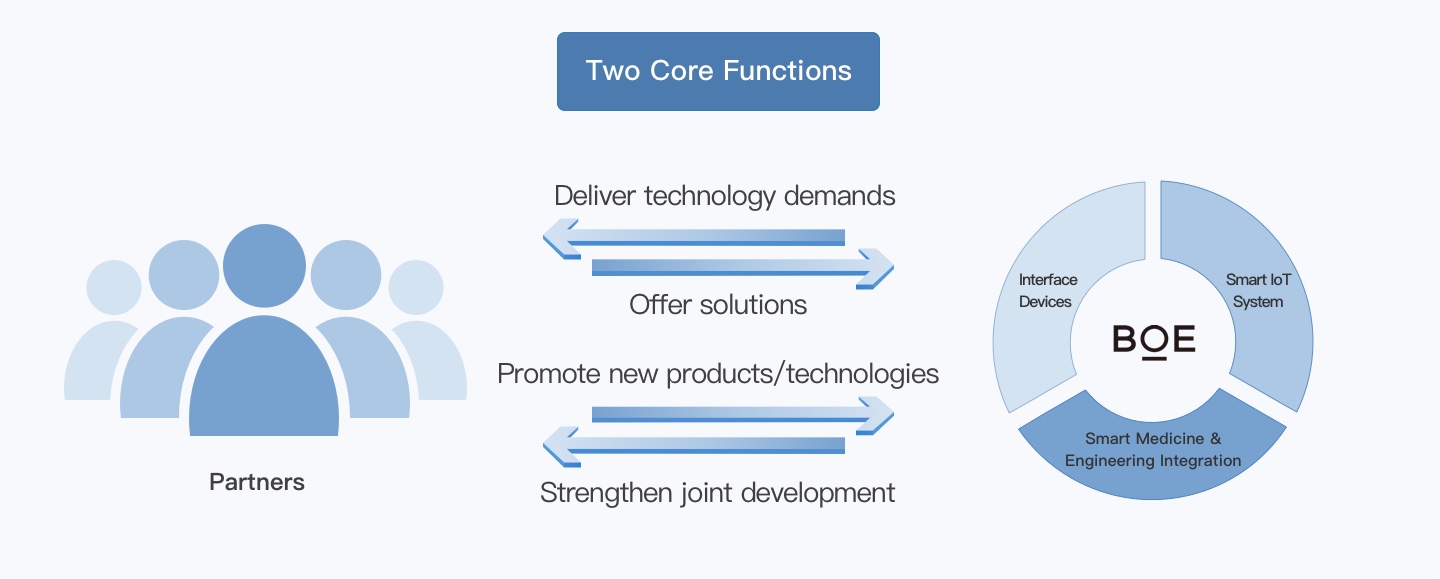

Enhancing Competitive Advantage with Loans for Businesses

In a competitive market, having access to the right resources can be the difference between success and failure. Loans for businesses can provide the capital needed to invest in competitive advantages, such as superior products, better customer service, or advanced marketing strategies. By enhancing competitive advantage, businesses can attract and retain customers, increase market share, and achieve sustained growth.

Loans for businesses are a powerful tool for growth and innovation. By providing the necessary capital to expand operations, invest in innovation, improve cash flow, and enhance competitive advantage, businesses can unlock their full potential and achieve long-term success. Whether you're looking to open new locations, invest in new technologies, or simply improve your cash flow, loans for businesses can help you overcome financial hurdles and achieve your business goals. With the right strategy and planning, loans can be a valuable asset in your business growth journey.