401k Withdrawal for a Home Purchase: How to Take a Loan from Your Retirement Account

Guide or Summary:Loan401kWithdrawalConsiderationsLoanWhen it comes to purchasing a home, one of the most significant financial hurdles you'll face is the do……

Guide or Summary:

Loan

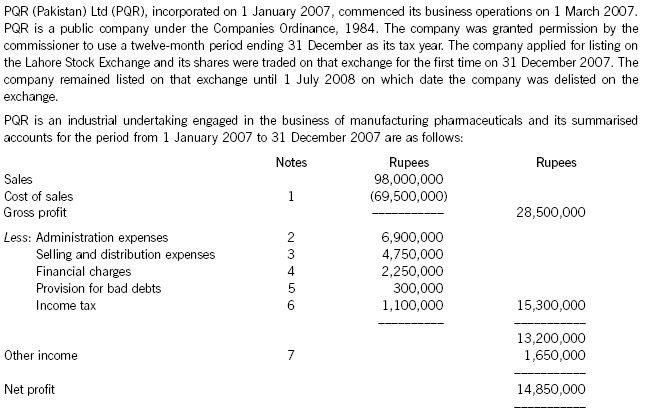

When it comes to purchasing a home, one of the most significant financial hurdles you'll face is the down payment. For many, this can be a daunting task, especially if you're just starting out in your career or have a limited income. However, there is a way to access funds from your retirement account to help you get into your first home: a loan from your 401(k).

401k

A 401(k) is a type of retirement plan offered by many employers. It allows you to contribute a portion of your pre-tax income, which grows tax-free until you withdraw it in retirement. While this is a great way to save for your future, it can also be a valuable tool for buying a home.

Withdrawal

Withdrawing money from your 401(k) is a serious decision, as it can have a significant impact on your retirement savings. However, for many, it's worth it to access the funds needed to purchase a home. Here's how it works:

1. Determine the amount you need: Before you apply for a loan, figure out how much money you need to buy your home. This will help you decide how much to borrow from your 401(k).

2. Check the terms of your 401(k) plan: Not all 401(k) plans offer loans, and those that do may have different terms and conditions. Make sure you understand what you're getting into before you apply.

3. Apply for the loan: Once you've determined the amount you need and checked the terms of your 401(k) plan, you can apply for the loan. This usually involves filling out a loan application and providing documentation to prove that you're a good candidate.

4. Receive the loan: If your application is approved, you'll receive the loan funds, which you can use to buy your home.

Considerations

While a loan from your 401(k) can be a great way to purchase a home, there are some important considerations to keep in mind:

1. Interest rates: Like any loan, you'll have to pay interest on the money you borrow. Make sure you understand the interest rate and how it will impact your payments.

2. Repayment terms: You'll also need to understand the repayment terms of the loan, including the length of the repayment period and the amount of interest you'll pay over time.

3. Impact on retirement savings: Remember that the money you borrow from your 401(k) is still part of your retirement savings. Make sure you have a plan in place to pay off the loan and avoid having to take money from your retirement account to do so.

4. Tax implications: Withdrawing money from your 401(k) to pay off a loan may have tax implications. Make sure you understand how this will impact your taxes and your retirement savings.

Buying a home is a major financial decision, and accessing funds from your 401(k) to help you get into your first home can be a great way to make it happen. However, it's important to carefully consider the terms of your loan, the impact on your retirement savings, and the tax implications. With careful planning and consideration, a loan from your 401(k) can be a valuable tool in helping you achieve your goal of homeownership.