Understanding Financial Aid: Do Student Loans Pay for Off-Campus Housing?

#### Translation: Do student loans pay for off-campus housing?When it comes to financing your education, understanding the nuances of student loans is cruci……

#### Translation: Do student loans pay for off-campus housing?

When it comes to financing your education, understanding the nuances of student loans is crucial, especially regarding living arrangements. One common question that arises among students is, **do student loans pay for off-campus housing?** This inquiry is particularly relevant for those who prefer to live outside the university campus for various reasons, including independence, proximity to work, or simply a preference for a different living environment.

#### What Are Student Loans?

Student loans are funds borrowed to pay for education-related expenses, which may include tuition, fees, books, and living costs. The loans must be repaid with interest after the student graduates or drops below half-time enrollment. There are various types of student loans, including federal loans, which often have lower interest rates and more flexible repayment options, and private loans, which may have stricter terms.

#### Understanding Off-Campus Housing

Off-campus housing refers to accommodations that are not owned or managed by the university. These can range from apartments and houses to shared living spaces. Many students opt for off-campus housing to gain more independence and choose their living conditions. However, living off-campus can come with additional costs, such as utilities, groceries, and transportation.

#### Do Student Loans Cover Off-Campus Housing?

The answer is yes, student loans can cover off-campus housing costs, but there are specific conditions to consider. When you apply for federal student loans, the school calculates your Cost of Attendance (COA), which includes tuition, fees, and estimated living expenses. If you choose to live off-campus, your COA will typically include a budget for housing costs, which can be used to determine how much you can borrow.

#### How Much Can You Borrow for Off-Campus Housing?

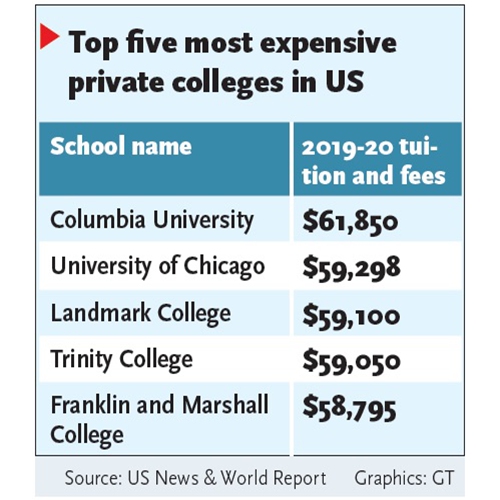

The amount you can borrow for off-campus housing depends on your school’s COA and your financial need. Generally, the COA for off-campus living may vary based on the location of the school and the average rental prices in the area. It’s essential to check with your school’s financial aid office to understand how they calculate your COA and what portion is allocated for housing.

#### What Expenses Are Covered?

When considering if **do student loans pay for off-campus housing**, it’s important to note that the loans can cover various living expenses. This includes rent, utilities, and sometimes even food costs. However, students should be mindful of the total amount borrowed, as loans must be repaid with interest, and accumulating debt can lead to financial strain post-graduation.

#### Tips for Managing Off-Campus Housing Costs

1. **Budget Wisely**: Create a budget that includes all your expected expenses, such as rent, utilities, groceries, and transportation. This will help you stay within your means and avoid unnecessary debt.

2. **Explore Housing Options**: Look for affordable housing options, such as shared apartments or living with roommates, which can significantly reduce costs.

3. **Communicate with Financial Aid Office**: Regularly check in with your school’s financial aid office to ensure you understand your loan options and COA, especially if you plan to live off-campus.

4. **Consider Part-Time Work**: If possible, consider a part-time job to help cover living expenses. This can reduce the amount you need to borrow and ease the financial burden after graduation.

In conclusion, **do student loans pay for off-campus housing** is a question that many students face. The answer is affirmative, but it requires careful planning and understanding of your financial situation. By being informed and managing your expenses wisely, you can make the most of your student loans while enjoying the benefits of off-campus living.