Discover the Cheapest Home Loans for First-Time Buyers in 2023

#### Cheapest Home LoansWhen it comes to purchasing a home, one of the most significant financial decisions you'll make is choosing the right loan. For firs……

#### Cheapest Home Loans

When it comes to purchasing a home, one of the most significant financial decisions you'll make is choosing the right loan. For first-time buyers, finding the cheapest home loans can be a game-changer, as it can save you thousands of dollars over the life of your mortgage. In this detailed guide, we will explore various options available in 2023 to help you secure the most affordable financing for your dream home.

#### Understanding Home Loans

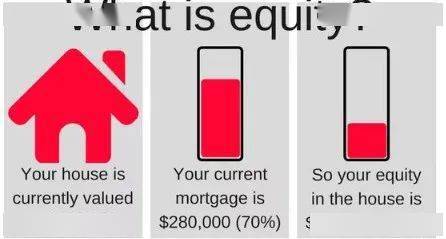

Home loans, or mortgages, are financial products that allow individuals to borrow money to purchase a home. These loans typically require the borrower to repay the principal amount plus interest over a specified period, usually ranging from 15 to 30 years. The interest rate, the term of the loan, and the down payment required can significantly affect the overall cost of the loan.

#### Types of Home Loans

There are several types of home loans available, each with its unique features and benefits. Understanding these can help you identify the cheapest home loans that suit your financial situation:

1. **Conventional Loans**: These are not insured or guaranteed by the government and usually require a higher credit score. However, they often come with competitive interest rates and terms.

2. **FHA Loans**: Backed by the Federal Housing Administration, FHA loans are designed for low-to-moderate-income borrowers. They allow for lower down payments and are more accessible to those with less-than-perfect credit.

3. **VA Loans**: Available to veterans and active-duty service members, VA loans offer favorable terms, including no down payment and no private mortgage insurance (PMI) requirement.

4. **USDA Loans**: These loans are for rural homebuyers and are backed by the U.S. Department of Agriculture. They offer 100% financing and are ideal for those looking to buy in eligible rural areas.

#### Finding the Cheapest Home Loans

To find the cheapest home loans, consider the following steps:

1. **Shop Around**: Different lenders offer varying rates and terms. It's crucial to compare multiple lenders to find the best deal. Use online comparison tools or consult with a mortgage broker.

2. **Check Your Credit Score**: Your credit score plays a significant role in determining your interest rate. Ensure your credit report is accurate and take steps to improve your score if necessary.

3. **Consider the Loan Term**: A shorter loan term may come with lower interest rates, but your monthly payments will be higher. Evaluate your budget to determine what works best for you.

4. **Look for Special Programs**: Many states and local governments offer assistance programs for first-time homebuyers, which can include lower interest rates or down payment assistance.

5. **Negotiate Fees**: Lenders may charge various fees, including origination fees and closing costs. Don’t hesitate to negotiate these fees or ask for them to be waived.

#### Conclusion

Finding the cheapest home loans requires diligent research and a clear understanding of your financial situation. By exploring different loan types, comparing lenders, and taking advantage of available programs, you can secure a mortgage that fits your budget and helps you achieve your homeownership dreams. Remember, the goal is not just to find the lowest interest rate, but to ensure that the loan fits your long-term financial goals. Happy house hunting!