"Maximize Your Financial Planning with an Education Loan Calculator Excel: A Comprehensive Guide"

---### Education Loan Calculator ExcelIn today’s world, pursuing higher education often requires significant financial investment. Many students and their f……

---

### Education Loan Calculator Excel

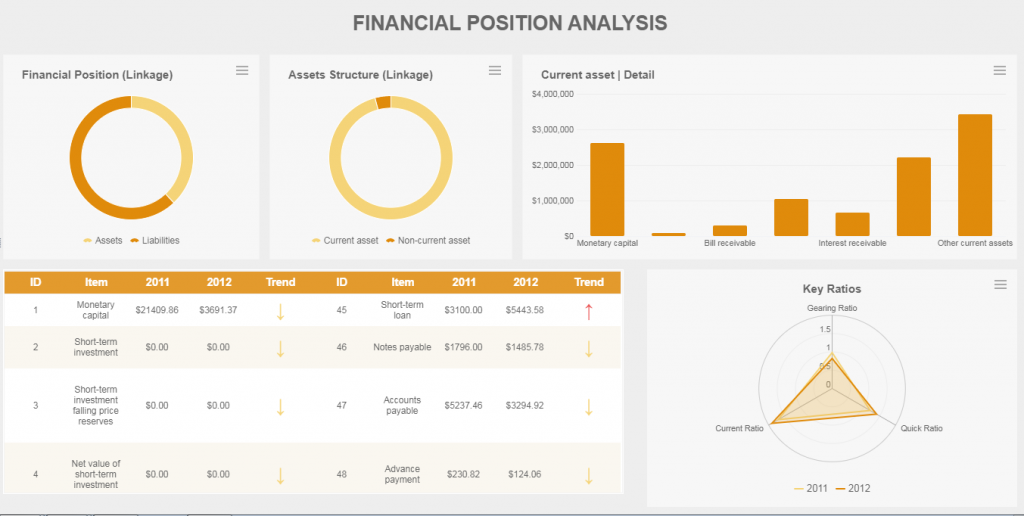

In today’s world, pursuing higher education often requires significant financial investment. Many students and their families rely on education loans to cover tuition fees, living expenses, and other costs associated with college or university. To effectively manage these loans, an Education Loan Calculator Excel can be an invaluable tool. This powerful spreadsheet allows users to calculate monthly payments, total interest paid, and the overall cost of the loan, helping to make informed financial decisions.

### Understanding the Importance of Education Loan Calculators

The rising costs of education can be daunting. According to recent statistics, college tuition has increased dramatically over the past few decades, leading many students to seek loans. An Education Loan Calculator Excel simplifies the process of understanding how much you will owe and the implications of borrowing money. By inputting variables such as loan amount, interest rate, and repayment term, students can visualize their financial future and plan accordingly.

### Key Features of an Education Loan Calculator Excel

1. **Loan Amount Input**: Users can enter the total amount they wish to borrow. This helps in calculating how much they will need to repay over time.

2. **Interest Rate**: The calculator allows users to input the annual interest rate, which significantly affects the total cost of the loan.

3. **Repayment Period**: Users can select the duration of the loan repayment, usually ranging from 5 to 20 years. This feature helps in determining monthly payments.

4. **Monthly Payment Calculation**: The calculator computes the monthly payment amount based on the entered variables, providing a clear picture of what to expect financially each month.

5. **Total Interest Paid**: One of the most critical aspects of borrowing is understanding how much interest will accumulate over the life of the loan. The calculator provides this figure, allowing users to see the true cost of their education.

### How to Use an Education Loan Calculator Excel

Using an Education Loan Calculator Excel is straightforward. Here are the steps:

1. **Download the Template**: Many free templates are available online. Download one that suits your needs.

2. **Input Your Data**: Enter the loan amount, interest rate, and repayment period into the designated fields.

3. **Analyze the Results**: Review the calculated monthly payments and total interest paid. This will give you a better understanding of your financial obligations.

4. **Adjust Variables**: Experiment with different loan amounts, interest rates, and repayment terms to see how they affect your monthly payments and total cost.

### Benefits of Using an Education Loan Calculator Excel

The benefits of utilizing an Education Loan Calculator Excel are numerous:

- **Clarity**: It provides clear insights into the financial commitments associated with education loans.

- **Planning**: Helps in budgeting for monthly payments and understanding the long-term financial impact of borrowing.

- **Comparison**: Allows for easy comparison between different loan offers and repayment options.

- **Empowerment**: Equips students and families with the knowledge to make informed decisions regarding education financing.

### Conclusion

In conclusion, an Education Loan Calculator Excel is an essential tool for anyone considering taking out a loan for higher education. By understanding the financial implications and planning accordingly, students can embark on their educational journey with confidence. Whether you are a prospective student or a parent, utilizing this calculator can lead to better financial outcomes and a clearer understanding of your investment in education. Don’t let the complexities of education loans overwhelm you; take control of your financial future today with the help of an Education Loan Calculator Excel.