Loan Management Account: Maximizing Efficiency and Minimizing Risks

Guide or Summary:Optimizing Loan PortfoliosEnhancing Risk ManagementImproving Customer SatisfactionDriving Financial SuccessIn the realm of finance, the loa……

Guide or Summary:

- Optimizing Loan Portfolios

- Enhancing Risk Management

- Improving Customer Satisfaction

- Driving Financial Success

In the realm of finance, the loan management account (LMA) stands as a cornerstone for institutions aiming to streamline their operations and enhance their risk management strategies. This article delves into the intricacies of the LMA, exploring how it can be leveraged to optimize loan portfolios, improve customer satisfaction, and ultimately, drive the financial success of organizations.

Optimizing Loan Portfolios

The primary function of the LMA is to provide a centralized platform for managing loan portfolios. By consolidating all loan-related data in one place, financial institutions can gain a comprehensive view of their loan assets, liabilities, and overall financial health. This centralized approach facilitates easier tracking of loan performance, identification of potential risks, and timely intervention to mitigate those risks.

One of the key benefits of the LMA is its ability to automate many of the manual processes associated with loan management. Automated systems can handle tasks such as loan origination, underwriting, disbursement, and repayment tracking. This not only reduces the chances of human error but also significantly speeds up the loan processing time, leading to increased customer satisfaction.

Enhancing Risk Management

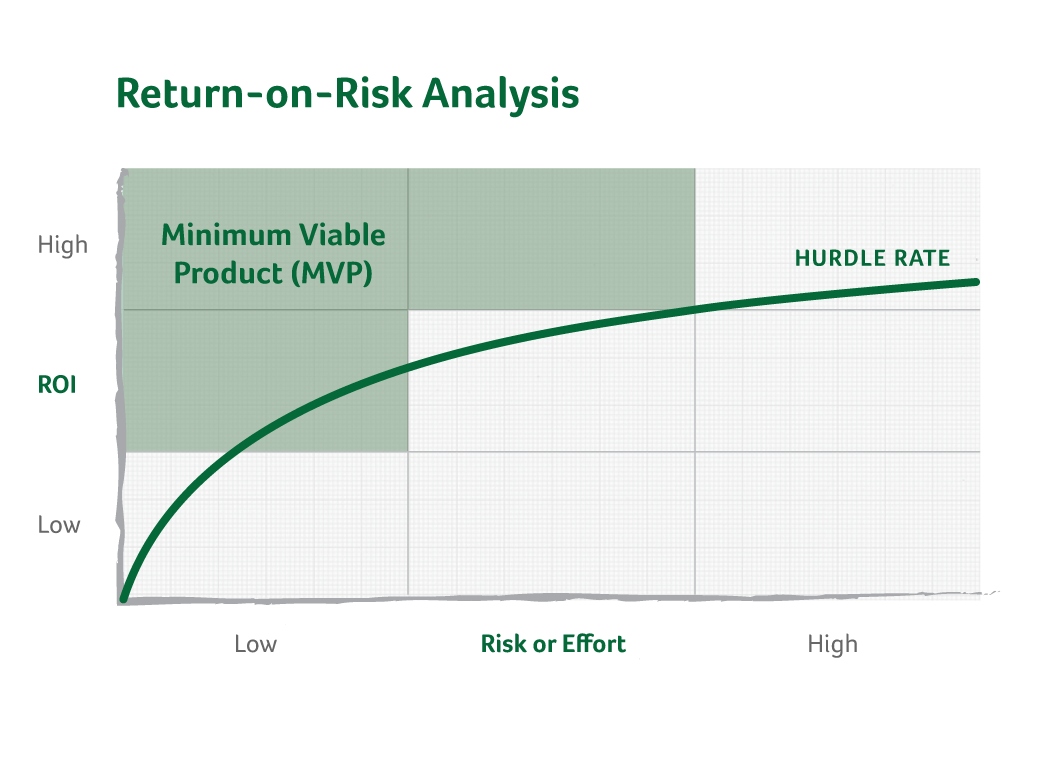

Effective risk management is paramount in the loan industry. The LMA plays a pivotal role in this aspect by providing robust tools and analytics to assess and monitor loan risks. By analyzing data such as credit scores, loan amounts, repayment history, and market conditions, financial institutions can identify potential risks and take proactive measures to mitigate them.

For instance, the LMA can highlight loans that are at a higher risk of default, enabling lenders to implement targeted strategies to recover these loans. Additionally, the LMA can provide insights into market trends and economic indicators, allowing financial institutions to adjust their loan portfolios accordingly and minimize their exposure to market risks.

Improving Customer Satisfaction

Customer satisfaction is a critical factor in the success of any financial institution. The LMA plays a significant role in enhancing customer satisfaction by providing a seamless and efficient loan management experience. With its automated processes, customers can expect faster loan approvals, quicker disbursements, and easier repayment tracking.

Moreover, the LMA enables financial institutions to offer personalized loan solutions to their customers. By analyzing customer data, such as their financial history and creditworthiness, financial institutions can tailor loan products that meet the specific needs and preferences of their customers. This personalized approach not only enhances customer satisfaction but also fosters loyalty and long-term relationships.

Driving Financial Success

Ultimately, the LMA is a strategic tool that can drive the financial success of organizations. By optimizing loan portfolios, enhancing risk management, and improving customer satisfaction, financial institutions can achieve higher profitability, increased market share, and sustained growth.

In conclusion, the loan management account is a powerful tool for financial institutions looking to enhance their operations and achieve their strategic goals. By leveraging the LMA, institutions can streamline their loan management processes, improve risk management, and provide a superior customer experience. In doing so, they position themselves for long-term financial success and growth in a highly competitive market.