"Unlocking Home Ownership: How to Secure a Mortgage Loan Without Income"

#### Understanding Mortgage Loans Without IncomeA mortgage loan without income is a financing option that allows potential homeowners to secure a mortgage e……

#### Understanding Mortgage Loans Without Income

A mortgage loan without income is a financing option that allows potential homeowners to secure a mortgage even if they are currently unemployed or do not have a traditional income source. This type of loan can be particularly beneficial for individuals who may have alternative sources of income, such as investments, rental properties, or savings, but lack a conventional paycheck.

#### Who Can Benefit from a Mortgage Loan Without Income?

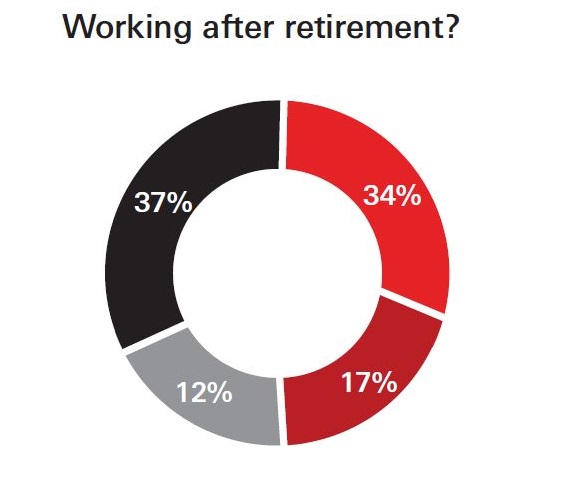

Many people find themselves in situations where they do not have a steady income but still wish to buy a home. This could include retirees living off savings and pensions, freelancers with fluctuating income, or individuals who have recently changed jobs. Additionally, those who are self-employed may struggle to prove consistent income through traditional means. For these individuals, a mortgage loan without income can provide a pathway to homeownership.

#### Types of Mortgage Loans Without Income

There are several types of mortgage loans available for those without traditional income. Some lenders may offer stated income loans, where borrowers can state their income without providing documentation. Others may look at assets, such as savings accounts or investment portfolios, to determine eligibility. Additionally, some lenders may consider the borrower's credit score and overall financial health, allowing for a more holistic view of their ability to repay the loan.

#### Requirements for Securing a Mortgage Loan Without Income

While securing a mortgage loan without income can be more challenging than traditional loans, it is not impossible. Lenders typically require a higher credit score and may ask for a larger down payment to mitigate their risk. Borrowers may also need to provide documentation of their assets, such as bank statements or proof of investments. It's crucial for individuals seeking this type of mortgage to prepare their financial information thoroughly and be ready to explain their unique situation to potential lenders.

#### The Application Process

Applying for a mortgage loan without income involves several steps. First, borrowers should gather all necessary documentation, including asset statements and credit reports. Next, they should research lenders who are open to non-traditional income verification. It’s advisable to consult with a mortgage broker who specializes in these types of loans, as they can provide valuable insights and help navigate the application process.

Once a borrower has identified potential lenders, they can begin the application process. This typically involves filling out a mortgage application, providing necessary documentation, and undergoing a credit check. After submission, lenders will review the application and may request additional information before making a decision.

#### Advantages and Disadvantages

Like any financial product, a mortgage loan without income comes with its own set of advantages and disadvantages. On the plus side, these loans can provide opportunities for individuals who might otherwise be excluded from the housing market. They can also offer flexibility in terms of income verification.

However, the downsides include potentially higher interest rates and stricter lending criteria. Borrowers may also face challenges in finding lenders willing to offer such loans, as they are less common in the market. It is essential for individuals to weigh these factors carefully before proceeding.

#### Conclusion

In conclusion, a mortgage loan without income can be a viable option for many individuals looking to achieve homeownership. By understanding the requirements, types of loans available, and the application process, borrowers can better navigate their options. With careful planning and the right approach, securing a mortgage without traditional income is possible, opening the door to homeownership for those who may have previously thought it unattainable.