### Discover Loan Student: Unlock Your Educational Dreams with Flexible Financing Options

In today's world, pursuing higher education is a crucial step toward achieving your career goals and personal aspirations. However, the rising costs of tuit……

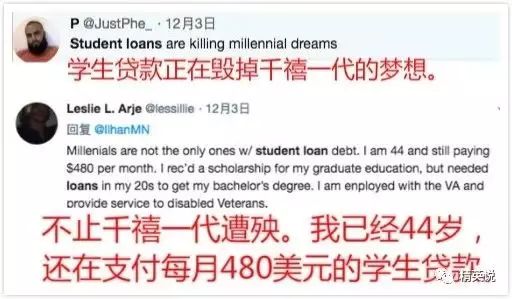

In today's world, pursuing higher education is a crucial step toward achieving your career goals and personal aspirations. However, the rising costs of tuition and associated expenses can create significant barriers for many students. This is where **discover loan student** options come into play, providing the financial support necessary to help you navigate the complexities of funding your education.

#### Understanding Student Loans

Student loans are financial products designed specifically to help students pay for their college or university expenses. They can cover tuition fees, textbooks, housing, and other essential costs. When you **discover loan student**, you open the door to various loan types, each with its own terms, interest rates, and repayment plans.

#### Types of Student Loans

1. **Federal Student Loans**: These loans are funded by the government and typically offer lower interest rates and more flexible repayment options. They include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans for graduate students and parents.

2. **Private Student Loans**: Offered by banks, credit unions, and other financial institutions, private loans can help fill the gap when federal loans and grants do not cover all educational expenses. However, they often come with higher interest rates and less flexible repayment options.

3. **State-Specific Loans**: Some states offer their own loan programs to residents, which may come with lower interest rates or unique benefits.

When you **discover loan student**, it is essential to research and compare these options to find the best fit for your financial situation and educational goals.

#### The Application Process

Applying for student loans can seem daunting, but understanding the process can make it more manageable. Here’s a step-by-step guide:

1. **Complete the FAFSA**: The Free Application for Federal Student Aid (FAFSA) is the first step in securing federal student loans. It determines your eligibility for federal financial aid, including grants, work-study, and loans.

2. **Research Loan Options**: After submitting the FAFSA, research different loan options. Compare interest rates, repayment terms, and borrower benefits to make an informed decision.

3. **Apply for Loans**: Once you’ve identified the loans you want, complete the application process. For federal loans, this typically involves signing a Master Promissory Note (MPN).

4. **Review Your Loan Agreement**: Before accepting any loan, carefully review the terms and conditions. Ensure you understand the repayment schedule, interest rates, and any fees involved.

#### Benefits of Student Loans

When you **discover loan student**, you gain access to several benefits that can enhance your educational experience:

- **Accessibility**: Student loans make higher education accessible to a broader range of individuals, allowing students to pursue their dreams without being limited by financial constraints.

- **Flexible Repayment Options**: Many student loans offer flexible repayment plans, including income-driven repayment options that adjust your monthly payment based on your income.

- **Build Credit History**: Successfully managing your student loans can help you build a positive credit history, which is essential for future financial endeavors, such as buying a home or a car.

- **Deferment and Forbearance Options**: In times of financial hardship, you may have the option to temporarily pause your loan payments through deferment or forbearance.

#### Conclusion

In conclusion, when you **discover loan student**, you are taking a significant step toward achieving your educational goals. By understanding the various loan options available, the application process, and the benefits of student loans, you can make informed decisions that set you up for success in your academic journey. Remember, education is an investment in your future, and with the right financial support, you can unlock the doors to endless opportunities. Don’t let financial barriers hold you back—explore your options today!