Who Has the Best Used Car Loan Rates? Discover the Top Options for Savvy Buyers!

Guide or Summary:Understanding Used Car Loan RatesWhere to Find the Best Used Car Loan RatesHow to Secure the Best Used Car Loan RatesWhen it comes to purch……

Guide or Summary:

- Understanding Used Car Loan Rates

- Where to Find the Best Used Car Loan Rates

- How to Secure the Best Used Car Loan Rates

When it comes to purchasing a used car, one of the most critical factors to consider is financing. Understanding who has the best used car loan rates can save you a significant amount of money over the life of your loan. With so many lenders and options available, it can be overwhelming to determine which route to take. In this guide, we'll explore the various sources for used car loans, compare rates, and provide tips on how to secure the best deal.

Understanding Used Car Loan Rates

Used car loan rates can vary significantly based on multiple factors, including your credit score, the lender's policies, and the age and condition of the vehicle. Typically, borrowers with higher credit scores will qualify for lower interest rates, while those with poorer credit may face higher rates. It's essential to shop around and compare offers from different lenders to find the most competitive rates.

Where to Find the Best Used Car Loan Rates

1. **Credit Unions**: Often, credit unions offer some of the best rates for used car loans. As member-owned institutions, they tend to have lower fees and more favorable terms compared to traditional banks. If you're a member of a credit union, it's worth checking their rates first.

2. **Online Lenders**: Many online lenders specialize in auto loans and can provide quick quotes with competitive rates. These lenders often have lower overhead costs, allowing them to pass savings onto borrowers. Make sure to read reviews and check their credibility before proceeding.

3. **Banks**: Traditional banks also offer used car loans, but their rates may not always be the most competitive. However, if you have an established relationship with your bank, you may be able to negotiate a better rate.

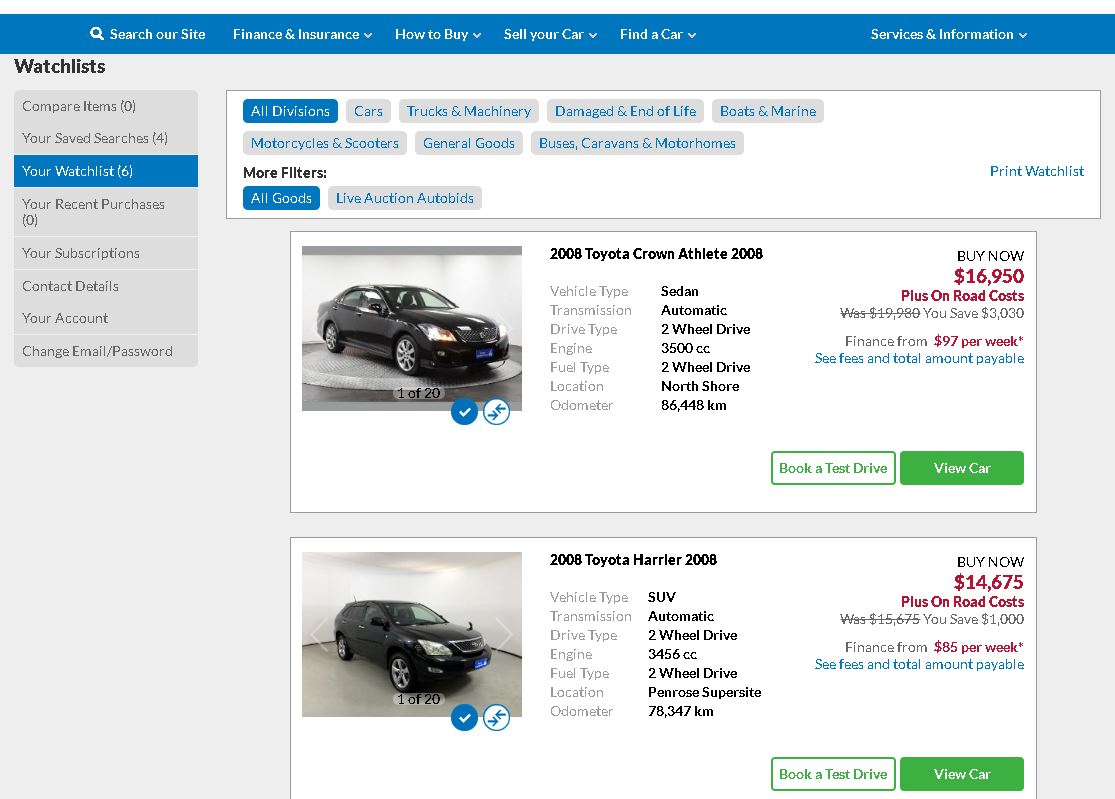

4. **Dealership Financing**: While convenient, dealership financing can sometimes come with higher interest rates. It's crucial to compare the dealership's offer with other lenders to ensure you're getting the best deal.

5. **Peer-to-Peer Lending**: This relatively new approach allows you to borrow money directly from individuals through online platforms. Rates can be competitive, but make sure to understand the terms and conditions.

How to Secure the Best Used Car Loan Rates

1. **Check Your Credit Score**: Before applying for a loan, check your credit score. If it's lower than you'd like, consider taking steps to improve it before applying. This could include paying down existing debt or correcting any errors on your credit report.

2. **Shop Around**: Don’t settle for the first offer you receive. Compare rates from multiple lenders to find the best deal. Use online comparison tools to make this process easier.

3. **Get Pre-Approved**: Getting pre-approved for a loan can give you a better idea of what rates you qualify for and help you negotiate better terms when dealing with dealerships.

4. **Consider the Total Cost**: When comparing rates, look beyond just the monthly payment. Consider the total cost of the loan, including interest and fees, to understand what you'll ultimately pay.

5. **Negotiate**: Don’t be afraid to negotiate the terms of your loan. If you find a better rate elsewhere, use that information to your advantage during discussions with lenders.

Finding out who has the best used car loan rates is essential for any savvy buyer looking to make a smart financial decision. By understanding your options and taking the time to shop around, you can secure a loan that fits your budget and saves you money in the long run. Remember, the key is to be informed and proactive in your search for the best financing options available. Happy car shopping!