Unlock Your Financial Freedom with Affordable Loans Georgia: Your Guide to Easy Approval and Competitive Rates

Guide or Summary:Loans Georgia refer to various lending options available to residents of Georgia. These loans can be used for multiple purposes, including……

Guide or Summary:

In today's fast-paced world, financial needs can arise unexpectedly, and having access to reliable funding is crucial. If you're a resident of Georgia, you're in luck! The state offers a variety of options when it comes to loans Georgia. Whether you’re looking for personal loans, auto loans, or even home equity loans, understanding the landscape can help you secure the best deal.

#### What Are Loans Georgia?

Loans Georgia refer to various lending options available to residents of Georgia. These loans can be used for multiple purposes, including consolidating debt, financing a new car, or covering unexpected medical expenses. The diversity of loan types means that borrowers can find a product that fits their specific financial situation.

#### Types of Loans Georgia

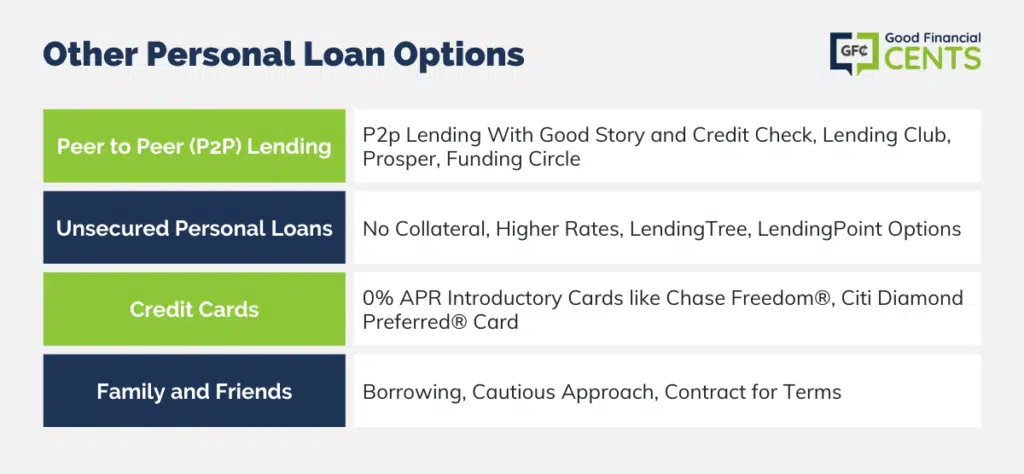

1. **Personal Loans**: These are unsecured loans that can be used for almost any purpose. They typically come with fixed interest rates and are paid back in monthly installments. Personal loans are ideal for those looking to make a large purchase or consolidate debt.

2. **Auto Loans**: If you're in the market for a new or used vehicle, loans Georgia offer competitive rates for auto financing. Many lenders provide flexible terms, allowing you to choose a repayment plan that fits your budget.

3. **Home Equity Loans**: For homeowners, tapping into your home’s equity can be a smart financial move. These loans typically offer lower interest rates compared to personal loans, making them a popular choice for home improvements or debt consolidation.

4. **Payday Loans**: While these should be approached with caution due to high-interest rates, payday loans can provide quick cash for emergencies. They are typically short-term loans that are due on your next payday.

#### Why Choose Loans Georgia?

Choosing loans Georgia means you have access to a wide range of lenders and competitive rates. Local lenders often understand the unique financial landscape of Georgia residents and can offer tailored solutions. Additionally, the application process is often streamlined, with many lenders providing online applications for convenience.

#### How to Secure the Best Loans Georgia

1. **Check Your Credit Score**: Before applying for any loan, it’s essential to check your credit score. A higher score can qualify you for better interest rates and terms.

2. **Shop Around**: Don’t settle for the first offer you receive. Compare rates and terms from multiple lenders to ensure you’re getting the best deal.

3. **Understand the Terms**: Read the fine print! Make sure you understand the interest rates, repayment terms, and any fees associated with the loan.

4. **Consider Local Credit Unions**: Often, local credit unions offer favorable terms compared to traditional banks. If you’re a member, it’s worth checking their loan options.

5. **Prepare Your Documents**: Having your financial documents ready can speed up the approval process. This typically includes proof of income, employment verification, and any other relevant financial information.

#### Conclusion

In conclusion, loans Georgia provide a valuable resource for residents looking to meet their financial needs. With a variety of options available, understanding the types of loans and their terms can empower you to make informed decisions. By shopping around and preparing adequately, you can unlock the financial freedom you desire. Whether you need a personal loan for a dream vacation, an auto loan for your next vehicle, or a home equity loan for renovations, Georgia's lending landscape is rich with opportunities. Don’t hesitate to explore your options today!