Are DSCR Loans Good for Your Investment Strategy? Discover the Benefits and Drawbacks!

#### IntroductionWhen it comes to financing real estate investments, many investors are exploring various loan options to maximize their returns. One popula……

#### Introduction

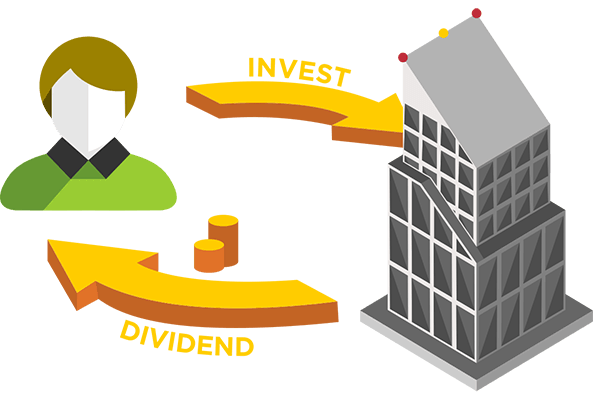

When it comes to financing real estate investments, many investors are exploring various loan options to maximize their returns. One popular choice that has emerged in recent years is the Debt Service Coverage Ratio (DSCR) loan. But the question remains: **are DSCR loans good** for your investment strategy? In this article, we will delve into the benefits and drawbacks of DSCR loans, helping you make an informed decision.

#### What are DSCR Loans?

DSCR loans are a type of financing specifically designed for real estate investors. They focus on the property’s ability to generate enough income to cover the loan payments. The Debt Service Coverage Ratio is calculated by dividing the property’s net operating income (NOI) by the total debt service (the total amount of debt payments). A DSCR of greater than 1 indicates that the property generates sufficient income to cover its debts.

#### Benefits of DSCR Loans

1. **Flexible Qualification Criteria**: One of the most appealing aspects of DSCR loans is their more lenient qualification requirements compared to traditional loans. Since these loans focus on the property’s income rather than the borrower’s personal income, they can be a viable option for investors with multiple properties or those who may not have a high personal income.

2. **Investment Property Focus**: DSCR loans are specifically tailored for investment properties, making them a great choice for real estate investors. This focus allows investors to leverage their property’s income potential, enabling them to acquire more properties and expand their portfolios.

3. **Higher Loan Amounts**: Because DSCR loans consider the income generated by the property, they can often provide higher loan amounts than conventional loans. This can be particularly beneficial for investors looking to purchase larger properties or those in competitive markets.

4. **Potential for Better Cash Flow**: With a DSCR loan, investors can potentially achieve better cash flow since the loan structure allows them to finance properties that may not qualify under traditional lending criteria. This can lead to increased profitability over time.

#### Drawbacks of DSCR Loans

1. **Higher Interest Rates**: While DSCR loans offer flexibility, they often come with higher interest rates compared to conventional loans. This can affect your overall profitability, especially if you’re financing multiple properties.

2. **Property Value Dependency**: The success of a DSCR loan heavily relies on the property’s ability to generate income. If the property underperforms, you may struggle to meet the debt service requirements, which could lead to financial difficulties.

3. **Limited Availability**: Not all lenders offer DSCR loans, which can limit your options. It’s essential to research and find lenders that specialize in these types of loans to ensure you get the best terms possible.

4. **Potential for Over-Leverage**: Investors may be tempted to take on more debt than they can handle due to the attractive nature of DSCR loans. It’s crucial to evaluate your financial situation and ensure that you’re not over-leveraging yourself, as this can lead to significant financial strain.

#### Conclusion

So, **are DSCR loans good** for your investment strategy? The answer depends on your individual circumstances, investment goals, and risk tolerance. While DSCR loans offer unique benefits, such as flexible qualification criteria and the potential for better cash flow, they also come with their own set of challenges. Before deciding, it’s essential to conduct thorough research, consult with financial advisors, and carefully evaluate your investment strategy. With the right approach, DSCR loans can be a valuable tool in your real estate investing arsenal.