Need Personal Loan? Discover Your Options for Quick Cash Solutions Today!

When life throws unexpected financial burdens your way, the need for a personal loan can arise suddenly. Whether it’s for medical expenses, home renovations……

When life throws unexpected financial burdens your way, the need for a personal loan can arise suddenly. Whether it’s for medical expenses, home renovations, or consolidating debt, understanding your options is crucial. If you need personal loan assistance, you’re not alone. Millions of people find themselves in similar situations, and thankfully, there are various avenues to explore for quick cash solutions.

#### Understanding Personal Loans

A personal loan is an unsecured loan that can be used for various purposes. Unlike a mortgage or auto loan, which are tied to specific assets, personal loans offer flexibility. You can use the funds for anything from unexpected medical bills to funding a dream vacation. The amount you can borrow typically ranges from a few hundred to several thousand dollars, depending on your creditworthiness and the lender’s policies.

#### Why You Might Need Personal Loan

There are many reasons why you might find yourself in need of a personal loan:

1. **Emergency Expenses**: Life is unpredictable. Medical emergencies or urgent home repairs can arise without warning, and having access to quick cash can alleviate stress.

2. **Debt Consolidation**: If you have multiple high-interest debts, consolidating them into a single personal loan can simplify your payments and potentially lower your interest rate.

3. **Home Improvements**: Investing in your home can increase its value. A personal loan can provide the funds necessary for renovations or repairs.

4. **Education Costs**: Whether it’s for yourself or a family member, education can be expensive. Personal loans can help cover tuition fees and other related expenses.

5. **Special Occasions**: Weddings, vacations, and other significant life events can be costly. A personal loan can help you celebrate without breaking the bank.

#### How to Apply for a Personal Loan

Applying for a personal loan is generally straightforward. Here are the steps you should consider:

1. **Check Your Credit Score**: Your credit score plays a crucial role in determining your eligibility and interest rates. Knowing your score can help you understand what loans you might qualify for.

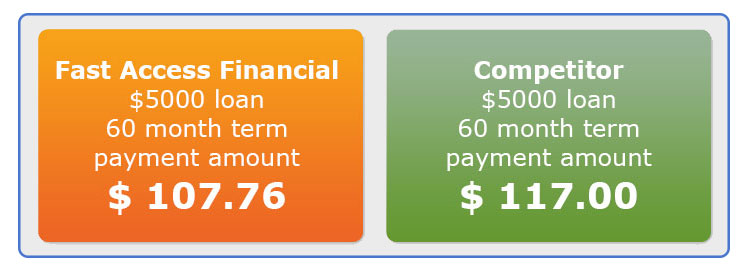

2. **Research Lenders**: Different lenders offer varying terms, interest rates, and fees. Take the time to compare options from banks, credit unions, and online lenders.

3. **Determine the Loan Amount**: Assess how much money you actually need. Borrowing more than necessary can lead to higher interest payments.

4. **Gather Documentation**: Lenders typically require proof of income, employment history, and other financial documents. Having these ready can expedite the application process.

5. **Submit Your Application**: Once you’ve chosen a lender, fill out their application form. Be honest and accurate with the information you provide.

6. **Review Loan Terms**: If approved, carefully review the loan terms before accepting. Pay attention to the interest rate, repayment timeline, and any fees involved.

#### Final Thoughts

If you find yourself in a situation where you need personal loan assistance, remember that there are options available. Take the time to research and understand your choices, and don’t hesitate to seek help if you’re unsure about the best course of action. A personal loan can be a valuable tool to help you navigate financial challenges, but like any financial product, it’s essential to use it wisely. Always consider your ability to repay the loan and avoid borrowing more than you can afford.