Understanding SBA Loan Terms: A Comprehensive Guide to Small Business Financing

#### SBA Loan TermsThe Small Business Administration (SBA) offers a variety of loan programs designed to support small businesses in their growth and develo……

#### SBA Loan Terms

The Small Business Administration (SBA) offers a variety of loan programs designed to support small businesses in their growth and development. Understanding SBA loan terms is crucial for entrepreneurs looking to secure funding. These terms dictate the conditions under which loans are granted, including interest rates, repayment periods, and eligibility requirements.

#### What are SBA Loans?

SBA loans are government-backed loans that provide favorable terms for small businesses that may struggle to secure traditional financing. The SBA does not directly lend money; instead, it guarantees a portion of the loan, which reduces the risk for lenders. This guarantee allows banks to offer loans with lower interest rates and longer repayment terms.

#### Types of SBA Loans

There are several types of SBA loans, each designed for specific purposes:

1. **7(a) Loan Program**: This is the most common SBA loan, providing up to $5 million for various business needs, including working capital, equipment purchase, and real estate acquisition.

2. **504 Loan Program**: This program is geared towards purchasing fixed assets like real estate and equipment. It typically involves a partnership between a private lender and a Certified Development Company (CDC).

3. **Microloan Program**: For smaller funding needs, the Microloan Program offers loans up to $50,000 to help start-ups and small businesses.

4. **Disaster Loans**: These loans provide financial assistance to businesses affected by natural disasters, helping them recover and rebuild.

#### SBA Loan Terms Explained

When considering an SBA loan, it's important to understand the key SBA loan terms involved:

- **Interest Rates**: SBA loans generally offer lower interest rates compared to conventional loans. The rates can vary based on the loan type and the lender, but they are capped by the SBA.

- **Repayment Periods**: SBA loans typically have longer repayment terms, ranging from 10 to 25 years. This extended period allows businesses to manage their cash flow more effectively.

- **Collateral Requirements**: Many SBA loans require collateral to secure the loan. This could include business assets, personal assets, or a combination of both.

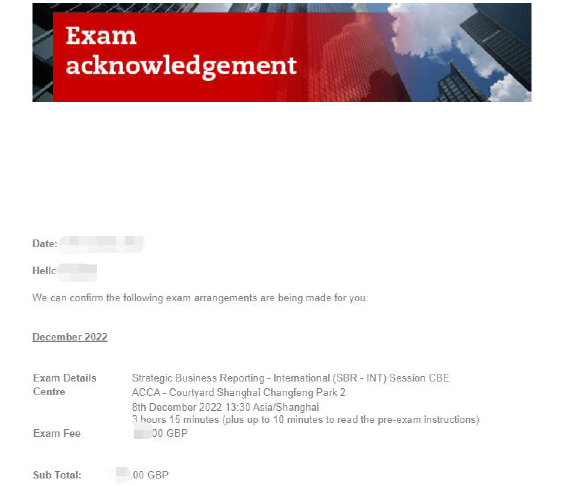

- **Fees**: Borrowers should be aware of various fees associated with SBA loans, including guarantee fees and closing costs. These fees can vary based on the loan amount and lender.

- **Eligibility Criteria**: To qualify for an SBA loan, businesses must meet specific criteria, including size standards, creditworthiness, and operational history. Start-ups may face additional scrutiny regarding their business plans and projections.

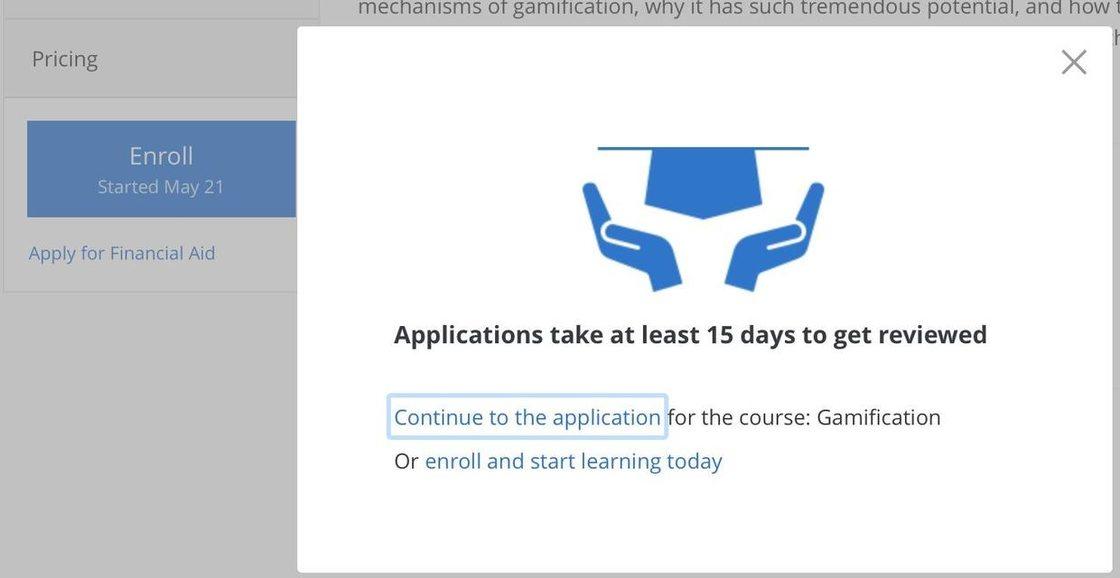

#### The Application Process

Applying for an SBA loan involves several steps:

1. **Determine Your Needs**: Assess how much funding you require and what you will use it for. This will help you choose the right type of SBA loan.

2. **Gather Documentation**: Prepare necessary documents, including financial statements, tax returns, business plans, and personal financial information.

3. **Find a Lender**: Research and reach out to lenders who participate in the SBA loan programs. Not all lenders offer the same terms, so it’s worth shopping around.

4. **Submit Your Application**: Complete the loan application, ensuring all documentation is accurate and complete. Incomplete applications can lead to delays or denials.

5. **Await Approval**: The lender will review your application and documentation. This process can take several weeks, depending on the lender and the complexity of your application.

6. **Close the Loan**: Once approved, you’ll go through the closing process, where you’ll sign the loan agreement and receive your funds.

#### Conclusion

Understanding SBA loan terms is essential for any small business owner considering financing options. By familiarizing yourself with the different types of SBA loans, their terms, and the application process, you can make informed decisions that will help your business thrive. Whether you’re looking to expand, purchase equipment, or recover from a disaster, SBA loans can provide the financial support you need to achieve your goals.