Understanding Home Loan Interest Rate 2018: A Comprehensive Guide for Homebuyers

Guide or Summary:Home Loan Interest Rate 2018Factors Influencing Home Loan Interest RatesTrends in Home Loan Interest RatesTips for Homebuyers in 2018Home L……

Guide or Summary:

- Home Loan Interest Rate 2018

- Factors Influencing Home Loan Interest Rates

- Trends in Home Loan Interest Rates

- Tips for Homebuyers in 2018

Home Loan Interest Rate 2018

In 2018, the landscape of home loan interest rates was characterized by various economic factors that influenced borrowing costs for prospective homebuyers. Understanding the home loan interest rate 2018 is crucial for anyone looking to purchase a home during that period. This guide will explore the trends, factors affecting rates, and tips for securing the best mortgage deals.

Factors Influencing Home Loan Interest Rates

Several key factors played a significant role in determining the home loan interest rate 2018. One of the primary influences was the Federal Reserve's monetary policy. Throughout 2018, the Fed raised interest rates multiple times, which directly impacted mortgage rates. As the central bank increased the cost of borrowing, lenders adjusted their rates accordingly, leading to a rise in home loan interest rates.

Additionally, inflation expectations and economic growth projections contributed to the fluctuation of mortgage rates. A growing economy often leads to increased demand for housing, which can push interest rates higher. Conversely, if economic indicators suggest a slowdown, lenders may lower rates to stimulate borrowing and spending.

Trends in Home Loan Interest Rates

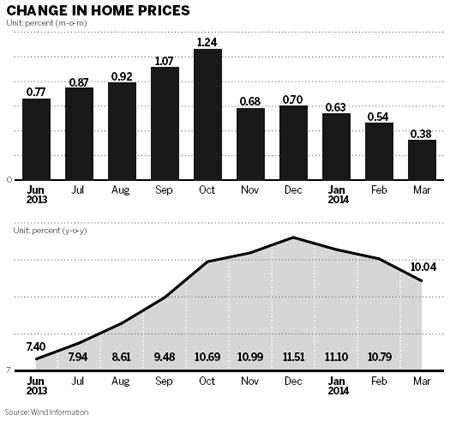

During 2018, home loan interest rates experienced an upward trajectory. At the beginning of the year, rates were relatively low, hovering around 4% for a 30-year fixed mortgage. However, as the year progressed, rates climbed, peaking at around 4.9% by the end of 2018. This increase was a significant concern for many homebuyers, as higher rates can translate into larger monthly payments and increased overall borrowing costs.

The rise in rates also affected the housing market. Many potential buyers were deterred by the higher costs, leading to a slowdown in home sales in some regions. However, the demand for homes remained strong in certain markets, particularly in areas with limited inventory.

Tips for Homebuyers in 2018

For homebuyers navigating the home loan interest rate 2018, there were several strategies to consider. First and foremost, it was essential to shop around for mortgage lenders. Different lenders offer varying rates and terms, so comparing multiple options can help secure a more favorable deal.

Additionally, potential buyers should consider locking in a rate when they find one that meets their needs. Rate locks can protect borrowers from future increases while they complete the home-buying process. It’s also advisable to improve one’s credit score before applying for a mortgage, as a higher score can lead to better interest rates.

Finally, homebuyers should be aware of the various types of mortgage products available. Fixed-rate mortgages provide stability with consistent payments, while adjustable-rate mortgages (ARMs) may offer lower initial rates but can fluctuate over time. Understanding the differences can help buyers choose the best option for their financial situation.

The home loan interest rate 2018 was a critical factor for homebuyers during that year. With rates on the rise, understanding the influences on mortgage rates and employing strategic approaches to home financing was essential for making informed decisions. As the market continues to evolve, staying informed about interest rate trends remains vital for anyone looking to purchase a home.